Start at Part 1 of this 5 part series.

Buyers come in all shapes and sizes, however we draw a general distinction between individuals/partnerships and companies/private equity:

Individual buyers

The primary motivation for individual buyers is loss aversion. Growing the business is important, but due to the fact that they are generally using their own money, the key consideration is how much risk they are taking on. The focus for individual buyers tends to be towards purchasing an income stream. Generally, they will be looking to run the business themselves.

They normally have a set amount of money to spend, and therefore will be looking for the best deal within their budget. In saying this, if your business is stable and has an excellent credit rating, buyers might be eligible to take out an SBA (Small Business Administration) loan to purchase the business using finance.

Some examples of individual buyers might include corporate employees, online entrepreneurs with experience looking to add more businesses to their portfolio or owners of traditional businesses that want to move into the online space.

If you are targeting individual buyers, it can be a good idea to place emphasis on how defensible the business is, aiming to display staying power in the market. For this reason, businesses with proprietary products or developed brands are the most attractive to individual buyers.

Companies/private equity

If we’re talking about businesses valued at over $2m, then we are dealing with a ‘different kettle of fish’. Companies will often be looking to acquire their competitors,

suppliers or other strategic businesses that can make up a valuable component of their business as they move into the future. Key considerations of companies are where the synergies lie, how they can use the combined resources of the business they are looking to acquire and their own to grow the business, expansion into new markets, and the positioning of the brand in the market. If your business is dealing with a reputable supplier, or has developed proprietary products, they might be driven to acquire these trademarks and relationships to distribute through their network. Companies that are looking to grow through acquisition tend to have access to credit, and can move quickly if the right deal presents itself.

Private equity and investment funds on the other hand, are driven by the requirement to provide a return on equity to shareholders. They need to be acquiring companies, as cash sitting idle in a bank account doesn’t make investors happy. Investment funds have the ability to act fast on quality deals, and can access lines of credit should they be required.

SHOULD I SELL MY FBA BUSINESS NOW OR LATER?

If you are considering whether to sell your successful FBA business, here are a few questions to help clarify your intentions:

- How much enjoyment am I getting out of the business? Does it feel like a chore, or would I be happy to continue managing the business?

- Why am I considering selling the business? Are there more interesting projects that I’m working on, or do I just need the money?

- Is the business at a point where it is attractive for buyers, or does it need some work to be presentable?

- Are there systems in place that make operating the business a breeze?

- Is the business growing? If not, then it will probably require some work before offering to buyers (if you want to get top dollar).

At the end of the day, this is a personal decision, and you alone are the best person to make this decision with respect to your personal situation. Factors that might influence this decision can range from financial to personal well-being. Some people sell their Amazon business to purchase an investment property, creating a stable (albeit smaller) cashflow to live from.

It is important to consider the timing of when to sell your business. If it is highly seasonal, selling before Christmas (or whenever your high season is) can be a great bargaining chip, as it puts pressure on buyers to close the deal before the high season begins. For seasonal businesses, it can be a good idea to sell the business after a few years of operation – so that you have reliable sales data, and can present the seasonal trends to potential buyers as part of the sales pitch.

WAYS OF SELLING ON AMAZON FBA BUSINESS

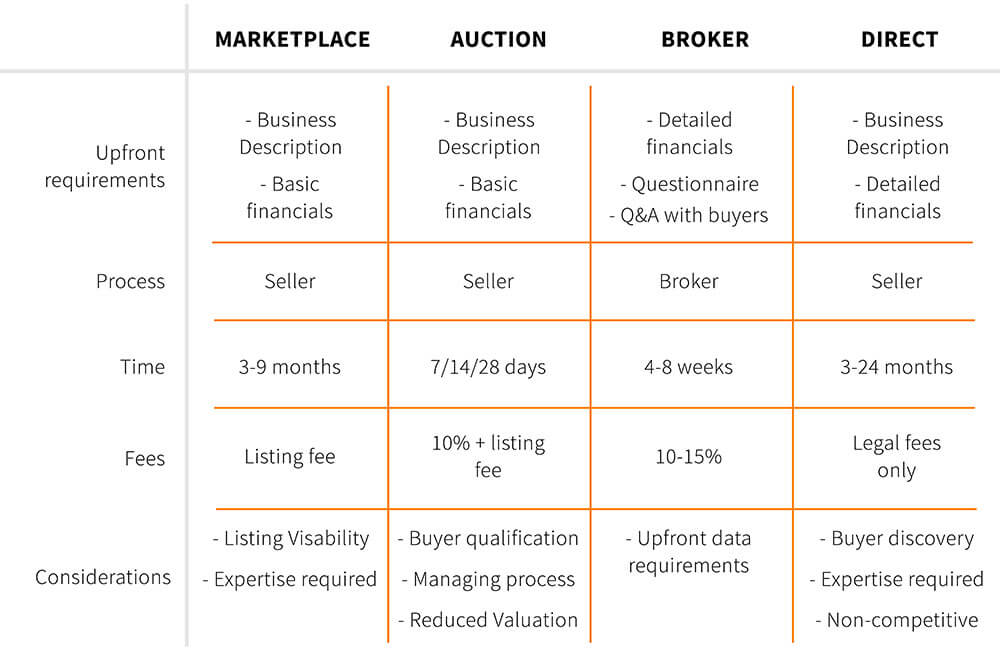

There are 4 ways to sell an Amazon FBA business: Marketplace, Auction, DIY and via a Broker:

Marketplace

- Timeframe – as with any business, this can vary. However, on average it can take 6-9 months.

- Personal involvement – as a seller, it is your job to take care of the sale from start to finish. This involves vetting buyers, getting NDA agreements signed, answering questions, negotiating between various buyers, preparing a contract for sale and facilitating the transaction through escrow.

- Fees – listing fee, legal expenses and taxes.

Business listing marketplaces tend to be crowded spaces with thousands of listings. If your business doesn’t stand out from the crowd, it might be tough to find many interested buyers (putting the bargaining power in the buyer’s hands). If you are experienced at buying and selling businesses, and have the time to run a listing, it can be a viable way to sell a business without incurring the fees of a broker. However, if you are a very busy person, or inexperienced at selling businesses, this might not be the best avenue to pursue.

To list your business for sale on a marketplace, you need to provide a description of the business, and some basic financials (prospectus). A popular business marketplace is www.bizbuysell.com.

Auction

- Timeframe – you set the amount of time that the auction lists for. 1-4 weeks is a common amount of time to find a buyer and sell the business. This time constraint can be great for creating competition between buyers. However, this often results in businesses simply not selling for the amount that you desire within the timeframe given.

- Personal involvement – similar to a marketplace listing. You provide business information and basic financials, then handle everything from end to end.

- Fees – listing fee, 10-15% success fee, legal expenses and taxes. You are paying a similar price to a broker, but you have to do all of the work.

Auction websites like www.flippa.com are great for selling businesses worth less than $5,000 with a quick turnaround time (flippa is also very popular for selling domain names). Buyers come to these auction marketplaces looking for a deal – expect 0.5- 1.5x earnings multiple. Often, these buyers are not seasoned business people, and it is not uncommon for it to be their first purchase, so you may need to guide them through the process. Selling via auction is a great way to gain a quick sale on a low value business, but is not necessarily ideal for medium-large FBA businesses.

DIY

- Timeframe – depends on who you know, and how desirable your business is. Say 3-24 months.

- Personal involvement – you do everything from start to finish, and don’t have the advertising reach of a marketplace, classifieds or auction network. Being a direct transaction, this method can be the most time consuming (unless you have already been approached by someone looking to buy your business).

- Fees – legal fees and taxes. This is by far the cheapest option to sell your business (given that you get the right price).

Generally, this method would involve researching potential buyers and cold calling on them to see if they are interested in purchasing your business. Potential buyers are often your competitors, so you do run the risk of divulging confidential information to those who value it most. If you are well established in the industry and have lots of contacts, it can often make sense to sell the business yourself. The DIY method lacks the competitive advantage of having lots of potential buyers, and tends to have a relatively low success rate. It is common for people to sell their business privately if they get approached by an interested buyer.

Broker

- Timeframe – many successful businesses that are sold through a broker tend to take 1-2 months to sell. However, it can take longer.

- Personal involvement – a broker does most of the work. Good brokers will help you to develop a prospectus, create marketing materials and promote it within their networks, help with due diligence, draft a sales agreement, and facilitate the financial exchange through an escrow service. This makes your job as the business owner a breeze.

- Fees – 10-15% commission, legal expenses and taxes. Some brokers also charge retainers. Brokers can help to reduce legal expenses by providing quality templates of legal agreements – your lawyer can simply review and edit the document rather than developing one from scratch.

If your business is worth more than $25,000 and you don’t have the time, experience or patience to sell your business, then listing with a broker is most likely your best option. Brokers are experienced in selling businesses and can easily answer any questions you may have along the way. They can help to maximize the sale value, and advise on appropriate terms to protect you legally.

To work with a broker, it is important to have all the required information at hand, and be organized. Their contacts tend to be ready and able to buy when the right deal presents itself.

Compared to selling privately or via marketplace, brokers do cost more. However, good brokers know how to get top dollar for your business (selling businesses is, after all, their forte). If you pay 15% in fees, but your business sells for 25% more, then you’re still winning at the end of the day!

Not all brokers are made equal, and choosing the wrong broker can hurt your bottom line. Here is a good article about things to look out for when choosing a broker.

==> Follow this link to Part 5 of this series in selling your FBA business. <==