Introduction to the 50/30/20 Rule for Budgeting

Are you tired of living paycheck to paycheck? Do you struggle to make ends meet every month? If so, money management may be challenging for you.

Budgeting basics are essential for anyone who wants to take control of their finances and build a stable financial future. The 50/30/20 rule is a budgeting method that has gained popularity in recent years.

It’s a simple way to allocate your income into different categories, allowing you to pay your bills, save for the future, and still have some money left over for fun. In this article, we’ll explore the basics of this method and how it can help you achieve your financial goals.

Understanding the 50/30/20 Rule

Navigating the world of personal finance can seem daunting, but the 50/30/20 rule of budgeting offers a simple, straightforward approach. This rule suggests dividing your income into three categories: Needs, Wants, and Savings, allocating 50% for essential expenses, 30% for discretionary spending, and 20% for savings and debt repayment. This method promotes financial discipline and a balanced lifestyle, enabling you to meet immediate expenses while building toward a secure financial future.

However, individual circumstances can impact its efficacy and may necessitate adjustments. Despite the variation, this rule serves as an effective tool in your personal finance toolbox, helping you avoid budgetary mishaps and fostering financial health. In subsequent sections, we’ll delve deeper into the workings of the 50/30/20 rule and how to tailor it to your unique financial circumstances.

Definition of the 50/30/20 Rule

Budgeting Basics: To establish a sound financial future, one must have an effective budgeting plan. In the world of personal finance, the 50/30/20 rule for budgeting has become a popular method for managing one’s money.

The 50/30/20 rule is a simple yet effective budgeting system that helps individuals to maintain their financial stability and achieve their financial goals without sacrificing their quality of life. Definition of the 50/30/20 Rule: The 50/30/20 rule is a budgeting guideline that suggests dividing your income into three categories: Needs, Wants, and Savings.

According to this rule, 50 percent of your income should be allocated to your essential expenses or needs, such as housing, utilities, groceries, transportation costs, and other mandatory bills. Thirty percent of your income should be dedicated to discretionary spending or wants such as entertainment and dining out expenses.

Twenty percent of your income should go towards savings for retirement, emergency funds, or paying off debt. The ultimate goal of this budgeting method is to help you prioritize where you spend your money based on what’s important while also ensuring you’re building healthy savings habits.

This means following the golden rules of money management; spending less than you earn and saving more than you spend so that you can secure your future finances. While it may not work for everyone in every situation due to different individual circumstances, such as higher living costs in certain areas or varying household sizes – there are several helpful tips available about how best to make this system work in practice.

How the 50/30/20 Rule Works

The 50/30/20 Rule is a budgeting tool that is designed to provide a simple and straightforward approach to managing your finances. With this rule, you allocate your income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

This approach helps you develop the habit of saving money while still being able to enjoy daily pleasures. The first category, which includes expenses such as rent/mortgage payments, utilities, groceries, transportation costs, and insurance premiums, falls under ‘needs.’

These are the expenses that are necessary for survival and cannot be avoided. The second category of expenses comprises “wants,” which includes items such as entertainment costs (e.g., dining out or attending social events), personal grooming expenses, or shopping trips.

This category should not exceed more than 30% of the total budgeted income according to this rule. Next comes savings and debt repayment, which covers emergency funds, retirement accounts contributions, investments in stocks/bonds/mutual funds, etc., along with paying off debts such as credit card bills or loans.

In essence, the 50/30/20 rule works by setting up an accountable structure for money management in your life. It offers individuals a solution to balance their financial goals by reducing overspending on nonessential items while prioritizing other important financial aspects like debt reduction or savings accumulation.

Instead of being overwhelmed by complex spreadsheets or budgeting methods that require extensive calculations or time commitment from individuals every month leading them to quit quickly; this approach makes it simpler by giving you more control over where your money goes without feeling constrained in any way. Hence it’s considered one of the budgeting basics recommended by many finance experts globally who advise people looking to get their finances on track with minimum effort but maximum results possible over time.

Implementing the 50/30/20 Rule

Unlocking the path to financial stability is more achievable than you might think. At the heart of this journey lies an effective budgeting plan, a financial blueprint that can guide you toward your goals. Among numerous budgeting strategies, the 50/30/20 rule stands out for its simplicity and adaptability. A handy tool for beginners and seasoned savers alike, this rule lays the foundation for smart money management.

To make the most of this rule, budgeting basics, such as keeping track of all spending on a monthly basis, are essential. This helps you avoid unpleasant surprises and make timely adjustments when needed. In the following section, we’ll illustrate how this rule works in real-life situations, offering examples that demonstrate its versatility and effectiveness across different income levels and lifestyle scenarios. By adhering to this simple guideline, you can take control of your finances and make your money work more effectively for you!

Step-by-Step Guide to Applying the 50/30/20 Rule

The 50/30/20 rule can be an excellent starting point for anyone looking to improve their budgeting skills. Here are some practical steps to follow when implementing the rule:

1. Determine your after-tax income: Before you can start creating a budget, you need to know how much money you have available each month. Calculate your total monthly income after taxes and other deductions have been taken out.

2. Categorize your expenses: Divide all of your monthly expenses into three categories: needs, wants, and savings.

3. Allocate 50% of your income to needs: Your essential expenses fall under this category, which includes rent or mortgage payments, utilities, groceries, and healthcare costs.

4. Spend no more than 30% on wants: This category encompasses everything that is not necessary but still adds value to your life, such as entertainment expenses or dining out.

5. Save at least 20% of your income: This allocation includes retirement savings, emergency funds, debt repayment plans, or any other financial goals that require saving.

Following these steps will help you get started with the 50/30/20 rule for budgeting. Remember that this approach is flexible and can be adjusted based on individual needs or financial goals.

Budgeting basics are at the core of achieving financial success with this rule so it’s important to keep track of all spending on a monthly basis. This way, adjustments can be made when necessary without having any surprises come end-of-month when bills come due for payment!

Examples of the 50/30/20 Rule in Action

Examples of the 50/30/20 Rule in Action The 50/30/20 rule for budgeting is a popular and effective method for managing your money. Let’s take a look at some examples of how this rule can be applied in real-life situations.

Example 1: John is a recent college graduate who just landed his first job. His take-home pay is $3,000 per month.

To apply the 50/30/20 rule, John would allocate $1,500 (50%) towards necessities such as rent, utilities, and groceries. He would then set aside $900 (30%) for discretionary spending such as dining out, entertainment, and hobbies.

He would put $600 (20%) towards savings and debt repayment. With this budget plan in place, John can meet his financial obligations while still enjoying his life without any guilt.

Example 2: Sarah is a single mother of two children who works part-time at a local retail store. Her monthly income is only $1,500, but she manages to stick to the 50/30/20 rule by making smart choices with her money management skills.

She allocates $750 (50%) for necessities such as rent, utilities, and groceries while setting aside $450 (30%) for discretionary spending like dining out or going to the movies with her kids once per month or buying them new clothes every six months. She puts away $300 (20%) into a savings account which helps her manage unexpected emergencies like medical bills or car repairs that may arise over time.

Example 3: Samantha earns $5,000 per month after taxes.

Needs- Samantha’s rent is $1500 per month; she spends $500 on groceries; her healthcare costs are $250; utility bills come up to $200; insurance premiums cost her about $100 – adding up to an estimated total of approximately $2,550. Wants- She spends around $1,000 on non-essential items like dining out with friends, clothing, and entertainment.

Savings- Samantha saves $1,450, which is 29% of her after-tax income.

Example 4: Michael earns $10,000 per month after taxes. Needs- Michael’s rent is $3,000 per month; he spends $2,000 on groceries; his healthcare costs are $500; utility bills come up to $400; insurance premiums cost him around $300 – adding up to an estimated total of approximately $6,200.

Wants- He spends around $3,000 on non-essential items like traveling and fine dining. Savings- Michael saves $1,800 for retirement (18%) and sets aside another 2% ($200) towards his emergency fund.

These examples demonstrate how the 50/30/20 rule can be implemented by people from all walks of life regardless of their income level or family status. By following this simple guideline for budgeting basics, you too can make your money work more effectively for you and achieve your financial goals with ease!

Benefits of the 50/30/20 Rule

The 50/30/20 rule is a popular budgeting technique due to its numerous benefits. If you’re looking for an easy-to-follow budgeting strategy that can help you achieve your financial goals, then the 50/30/20 rule is worth considering.

Here are some of the benefits of this approach to budgeting. One key benefit of the 50/30/20 rule is that it provides a simple and straightforward way to divide your income and allocate your expenses.

By using this technique, you’ll be able to easily understand where your money is going and how much you have left over each month. This can help reduce stress and anxiety around money management, as you’ll have a clear picture of your financial situation at all times.

Another benefit of the 50/30/20 rule is that it encourages saving for both short-term and long-term goals. With 20% of your income earmarked for savings, you’ll be able to build up an emergency fund, save for a down payment on a house or car, or invest in retirement accounts.

This approach helps ensure that you’re not only meeting your current needs but also planning for the future by setting aside funds for emergencies and other unexpected expenses. Overall, the 50/30-20 rule provides a solid foundation for effective budgeting by keeping things simple while also promoting responsible spending habits and saving strategies.

Success Stories of the 50/30/20 Rule

The 50/30/20 rule for budgeting has been celebrated by many financial experts as a simple and effective budgeting strategy that can help people achieve their financial goals.

There are numerous success stories of individuals and families who have implemented this rule and been able to improve their financial situation. By following the 50/30/20 rule, many have overcome debt, built savings, and attained better control over their finances.

One success story features a family who struggled with overspending and debt. They adopted the 50/30/20 rule and used it as a blueprint to reorganize their money management.

By allocating 50% of their income towards essentials such as food, housing, transportation, and bills, they were able to live within their means while avoiding unnecessary expenses. They allocated 30% of their income towards discretionary spending such as entertainment or hobbies – keeping them motivated to adhere to the strict essentials budget without feeling like they were missing out on fun activities.

The remaining 20% was put towards building up an emergency fund and paying off debts. After a year of diligently following this strategy, they were able to become debt-free and achieve financial stability.

Another success story highlights how adopting this simple budgeting technique can lead to achieving big financial goals over time. A young man in his early twenties started using the 50/30/20 rule when he landed his first full-time job after college graduation.

Despite having student loans requiring monthly payments that took up much of his income allotted for discretionary spending under this plan – he continued making these payments while allocating his remaining income according to the principles of this rule. Within just two years’ time, he was able to pay off all of his student loans thanks in part due to being disciplined with spending habits set forth by adhering strictly toward following out each category’s specific percentage limit without deviation or exception—thus demonstrating the power of budgeting basics and how they can lead to success.

Drawbacks of the 50/30/20 Rule

Money management is an essential skill that everyone should learn. While the 50/30/20 rule for budgeting can be a helpful tool, it also has its limitations and drawbacks. Here are some of the potential drawbacks to consider before applying this budgeting method to your financial situation.

Firstly, one major limitation of the 50/30/20 rule is that it provides a general guideline rather than a personalized plan tailored to an individual’s unique financial situation. The rule is based on percentages and does not take into account individual income levels, expenses, debts, or financial goals.

Therefore, if someone has high debts or high living expenses in relation to their income, following the 50/30/20 rule may not be enough to achieve their financial goals. Additionally, income inequality may make it difficult for individuals with low incomes or those living in expensive cities to follow this budgeting rule without sacrificing necessities.

Another drawback of using the 50/30/20 rule for budgeting is that it doesn’t account for unexpected expenses or emergencies. Everyone experiences unexpected costs from time to time, whether it’s an emergency medical bill, car repair costs, or job loss.

Following the 50/30/20 budgeting method may leave little room for emergencies and can lead to debt accumulation in these situations. It may be wise for individuals who frequently experience unexpected expenses or have unstable income streams to allocate more funds toward their emergency fund rather than following this strict spending guideline.

While the 50/30/20 rule offers a simple framework for managing finances and saving money, it’s important to understand its limitations before implementing it into your life as part of your money management routine. Overall, despite these limitations and drawbacks, understanding budgeting basics supported by this method can help you take control of your finances and create a more secure financial future if applied correctly with some personalization according to individual needs.

Situations Where the 50/30/20 Rule May Not Work

Money management is a critical aspect of financial planning, and while the 50/30/20 rule is an excellent budgeting approach for many people, there are some situations where it may not work as well. One such situation is when an individual’s expenses exceed their income, leading to negative cash flow.

Under such circumstances, the 50/30/20 rule may be ineffective since it does not account for debts and other financial obligations that go beyond the allocated 50% of essential expenses. Another situation in which the 50/30/20 rule may not be suitable is when an individual has a unique set of circumstances that make their financial goals different from those assumed by the rule.

For instance, those with irregular incomes may find it challenging to implement a consistent budget using this method. The 50% essential expenses allocation could also be too high or too low, depending on one’s location or income level.

In such cases, it may be necessary to tweak the percentages assigned to each category or consider alternative budgeting methods that better suit one’s particular needs. budgeting basics suggest that while the 50/30/20 rule can generally work for most people who have fixed incomes and regular expenses without significant debt obligations or unique circumstances, its limitations must also be considered before adopting it fully.

Ultimately, every individual’s financial position is unique; thus, there is no one-size-fits-all approach to money management. It would help if you assessed your particular situation critically before deciding whether this budgeting technique will work effectively for you or whether alternative options, such as zero-based budgeting or envelope budgeting, may better fit your needs.

Alternatives to the 50/30/20 Rule

With the rising cost of living and the constant shift in the economy, effective money management has become a necessity more than ever. But how does one strike a balance between income, savings, and expenditures? The key lies in effective budgeting, a skill that often feels more like an art. A range of budgeting techniques has emerged to guide individuals in their quest for financial stability. While the 50/30/20 rule has widely been adopted, it’s not the one-size-fits-all solution to budgeting. Let’s embark on a financial journey exploring other effective budgeting techniques that could prove pivotal in your financial well-being.

The envelope system, zero-based budgeting, and the balanced money formula are among the myriad of strategies one can adopt to better manage their funds. These methodologies, each with their unique perspectives and methods, can aid individuals in navigating the often treacherous financial waters. However, the optimal approach isn’t necessarily universal; it’s intrinsically personal, much like a tailor-made suit, and depends largely on one’s financial situation, lifestyle, and fiscal goals.

While all these methods offer unique advantages, they also carry specific drawbacks. Comparing them to the 50/30/20 rule and each other will shed light on which technique, or combination thereof, might work best for your unique financial needs and goals.

Money management, at its core, is about finding a method that suits you, not adapting yourself to fit a method. So take time to explore, understand, and test these budgeting techniques. The ultimate goal is to find a strategy that matches your lifestyle and financial aspirations, providing you with a sense of control and confidence in your financial future. Remember, personal finance is just that—personal. Find a strategy that works for you and stick with it. It’s not about perfection but rather progress and consistency. Happy budgeting!

Budgeting Technique Alternatives

Money management is an important aspect of personal finance, and there are several budgeting techniques available to help individuals manage their finances effectively. The 50/30/20 rule for budgeting is just one of many methods that can be used to create a budget. Other popular budgeting techniques include the envelope system, the zero-based budget, and the balanced money formula.

The Envelope System

The envelope system is a cash-based budget where individuals allocate their funds into different envelopes based on spending categories. For example, one envelope may be used for groceries, another for entertainment expenses, and another for rent or mortgage payments.

This technique allows individuals to physically see how much money they have allocated for each spending category while ensuring that they don’t overspend in any given area. The main drawback of this method is that it only works with cash payments and may not be practical in all situations.

The Zero-Based Budget

The zero-based budget is a method where individuals allocate every single dollar of their income towards specific expenses or savings goals. In this approach, all expenses must be accounted for and prioritized based on importance.

This can help people gain control over their finances by identifying areas where they can reduce spending or reallocate funds towards more pressing financial goals such as debt repayment or emergency savings. However, this method requires meticulous record-keeping skills and may not be suitable for everyone.

The Balanced Money Formula

The balanced money formula recommends that individuals allocate 50% of their income towards “needs,” such as housing costs and bills, 30% towards “wants,” such as entertainment expenses or dining out, and 20% towards savings goals, such as retirement or emergency funds. This formula provides flexibility while still prioritizing essential expenses first and foremost.

It’s also easy to understand and implement but does not account for individual financial situations, which could make it difficult to apply in some cases. Overall it’s important to understand that there are various methods available when considering Money Management strategies but choosing a specific technique or combination of strategies will depend on an individual’s financial goals, situation, and personal preferences.

Tools and Resources for the 50/30/20 Rule

Money management can be difficult, especially when you are starting out, and the 50/30/20 rule can help. There are various tools and resources available to help implement this budgeting technique effectively.

By using these resources, you can build a strong financial foundation and better manage your finances. Firstly, there are many budgeting apps available like Mint, YNAB (You Need A Budget), or PocketGuard, that assist in implementing the 50/30/20 rule.

Budgeting apps offer user-friendly interfaces to track your income and expenses automatically and make adjustments based on the rule’s principles. By linking your accounts with these apps, all transactions will be categorized automatically into wants or needs categories to assure adherence to the 50/30/20 rule.

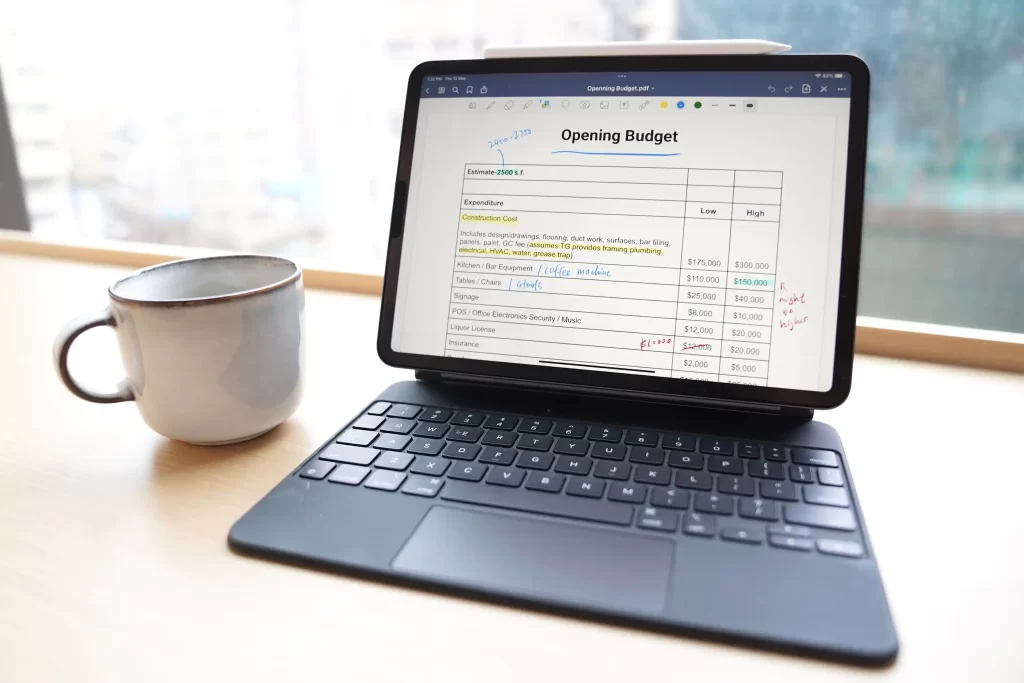

Furthermore, they provide a visual representation of spending patterns which makes it easier for you to identify areas where more cutbacks may be necessary. Secondly, an Excel spreadsheet is also a great tool for implementing the 50/30/20 rule since it allows further customization of budgets based on individual preferences.

Excel provides flexibility in creating personalized budget templates that cover various monthly expenses like rent/mortgage payments, utility bills, and entertainment costs, as well as saving ones which gives a fuller picture of one’s finances. With Microsoft Office packages readily available worldwide with reasonable subscription fees for individuals or families, commonly used software like Excel could be another effective platform for money management using the 50/30/20 rules, which eases regular tracking of expenses and income without internet connectivity dependency compared to budgeting apps_.

Budgeting Tools to Implement the 50/30/20 Rule

Budgeting Tools to Implement the 50/30/20 Rule Money management can be daunting; however, there are several budgeting tools available to make the process much simpler.

Most of these tools enable you to track expenses, create a budget, and monitor financial goals on a daily basis. The following budgeting tools can be used to implement the 50/30/20 rule:

1. Mint: This is an online budgeting tool that enables you to connect your bank accounts, investment accounts, and credit cards in one place. Here, you can track your expenses and income by creating custom categories for your spending, such as food, entertainment, or rent.

2. PocketGuard: PocketGuard is an app that links your bank accounts and credit cards together so that you can track all of your expenses and keep tabs on how much money you have left over for the month after paying bills.

3. YNAB: You Need A Budget (YNAB) is a comprehensive money management tool that prioritizes goal setting and encourages users to give every dollar a job.

Once you connect all of your accounts to YNAB, it will help guide you through creating a monthly budget based on the 50/30/20 rule. budgeting basics are critical components of any successful personal finance plan.

4. Empower: is an excellent money management tool that allows users to see their entire financial picture in one place while also offering investment advice based on their goals. 5. EveryDollar: EveryDollar is Dave Ramsey’s signature affordable online budgeting tool centered around his zero-based approach (allocating every dollar).

Users begin by assigning each dollar they earn across different categories like groceries or utility bills before allocating anything towards savings or debt payoff. By using these tools inside Money management institutions’ technology like banks, apps, or websites automatically categorizes transactions into preset categories such as groceries or utilities for easy tracking and monitoring of spending.

Helpful Resources for Understanding and Applying the 50/30/20 Rule

Helpful Resources for Understanding and Applying the 50/30/20 Rule: Money management is a critical aspect of personal finance, and the 50/30/20 rule is an excellent tool to help individuals get started with budgeting. To make it even easier, several resources can help you learn about the rule and apply it to your finances.

Some of these resources include online calculators, mobile applications, and budgeting worksheets. Online calculators are useful tools that can help you calculate your expenses based on the 50/30/20 rule.

These calculators work by inputting your income, debt payments, monthly bills, and other necessary expenses into different categories. Once you’ve entered all your financial information into the calculator, the tool will provide a breakdown of how much money should be allocated to each category.

This way, you can adjust your spending habits accordingly to ensure that you meet all your financial obligations while still adhering to the 50/30/20 rule. Budgeting worksheets are also helpful resources for those who want to use the 50//30/20 rule for budgeting basics.

These worksheets are available online or in print form and allow individuals to track their expenses manually. They include categories such as housing costs, transportation costs, groceries and food expenses, and debt repayments, among others, where one is required to fill in actual amounts spent every month or week, depending on preference.

This information helps individuals evaluate their spending habits accurately while giving them an idea of which areas they need to reduce their spending while still adhering to the 50//30/20 principle accurately. Mobile applications are also available that can assist with money management using this method by tracking expenses automatically with no need for manual data entry into a spreadsheet or worksheet hence saving time and making monitoring spending more efficient hence sticking more rigorously with budget goals set using this method”.

Conclusion: Is the 50/30/20 Rule Right for You?

Money management is a crucial aspect of one’s financial life, and the 50/30/20 rule for budgeting is just one of many ways to approach it. As we have seen throughout this article, the 50/30/20 rule has its advantages and disadvantages, and it may not be the best fit for everyone. With that in mind, it is important to take a closer look at your financial situation and assess whether this budgeting technique suits your needs.

Assessing Your Financial Situation: Before deciding whether or not to implement the 50/30/20 rule, it is essential to take stock of your financial situation. For instance, if you have significant debts or expenses that require more than 50% of your income, then you may need to adjust the ratio accordingly.

Similarly, if you are saving for a specific goal, such as a down payment on a house or retirement planning, then you might want to allocate more than 20% towards savings. Understanding your unique financial needs and goals will help determine whether the 50/30/20 rule aligns with them.

Making the Best Budgeting Decision for Your Needs: Ultimately, deciding on whether or not the 50/30/20 rule works for you depends on various factors, such as personal preferences and lifestyle choices. It helps to consider alternatives, such as other budgeting techniques we discussed earlier in this article, or even seek professional advice from financial advisors.

The important takeaway here is that budgeting basics include having an organized plan that helps control spending while ensuring sufficient savings toward future goals. Consider all factors at play when making money management decisions – what works best for someone else might not work well for you.

Assessing Your Financial Situation

It’s important to assess your financial situation before deciding if the 50/30/20 rule is right for you.

Budgeting basics always start with taking a clear look at your income and expenses. You need to know how much money you’re bringing in each month and where that money is going.

Take note of your average monthly income after taxes, as well as any irregular sources of income, such as bonuses or commissions. Next, make a list of all of your expenses.

This includes both fixed expenses that are the same amount each month (such as rent or mortgage payments) and variable expenses that change from month to month (such as utilities or groceries). Be sure to include any irregular expenses that may pop up occasionally (such as car repairs or medical bills).

Once you have an accurate summary of your income and expenses, it’s time to evaluate whether or not the 50/30/20 rule will work for you. Money management is key when assessing your financial situation.

It can be helpful to break down your monthly spending into categories such as housing, transportation, food, and entertainment. By doing this, you can see where most of your money is going each month and where there may be opportunities to cut back on spending in order to save more money.

Additionally, take note of any debt payments you may have each month (such as credit card bills), which will need to be factored into your budgeting plan. With a clear understanding of how much money is coming in versus how much is going out each month, you can make an informed decision about whether the 50/30/20 rule is a good fit for your financial situation.

Making the Best Budgeting Decision for Your Needs

When it comes to money management, there is no one-size-fits-all approach. The 50/30/20 rule for budgeting may be the perfect solution for some individuals, but it is not always the best decision for everyone. To make the best budgeting decision for your needs, you must take into consideration several factors.

First and foremost, assess your income and expenses to determine if the 50/30/20 rule aligns with your financial goals. If you have a high debt-to-income ratio or limited income, this rule may not be appropriate for you.

In such cases, consider other budgeting basics like prioritizing debt payments or cutting back on non-essential expenses until you can allocate a higher percentage of your income towards savings. Additionally, evaluate how much financial flexibility you need in case of emergencies or unexpected expenses.

If having more emergency savings is a priority, consider adjusting your percentages accordingly rather than sticking rigidly to the 50/30/20 guideline. Ultimately, successful money management requires discipline and consistency.

Whether you choose to follow the 50/30/20 rule or another budgeting technique that suits your needs better, remember that making any kind of positive change takes time and effort. With patience and dedication toward achieving your financial goals, you can create a sustainable plan that works for you over the long term.

Unlock even more control over your finances with our enlightening piece, The Power of Zero-Based Budgeting. Dive into the profound possibilities of a budgeting style that assigns every dollar a job, blending brilliantly with the 50/30/20 rule. It’s time to unleash the financial maestro in you; a click away lies the world of strategic money management waiting for your discovery!