Introduction: What is Traditional Budgeting?

Traditional budgeting is a widely used method of managing personal finances that involves setting specific spending limits for various expense categories. It is a systematic approach to money management that helps individuals track their income, plan their expenses, and ensure financial stability.

In traditional budgeting, individuals typically allocate predetermined amounts of money towards necessities, discretionary items, savings, and debt repayment. This method has been practiced for centuries and remains popular due to its effectiveness in providing structure and control over one’s financial situation.

The process of traditional budgeting begins with a thorough analysis of an individual’s income and expenses. It requires a meticulous examination of past spending habits to determine patterns and identify areas where adjustments can be made.

Once the income sources are established, and the expenditures are categorized into different segments such as housing, transportation, groceries, entertainment, etc., realistic targets are set for each category based on the individual’s financial goals. By adhering to these predetermined limits on spending in each category, individuals gain a sense of discipline and accountability when it comes to managing their finances.

Traditional budgeting acts as a roadmap that guides one’s spending decisions throughout the month or year. It provides clarity on where money should be allocated while considering both short-term needs and long-term financial objectives, such as saving for retirement or paying off debts.

Moreover, traditional budgeting encourages mindful spending by highlighting areas where unnecessary expenses can be reduced or eliminated altogether. By closely monitoring one’s cash flow through regular tracking of expenses against the predetermined allocations within each category, individuals become more aware of their financial habits and can make informed decisions about how they allocate their resources.

Traditional budgeting is an effective tool for managing personal finances because it provides structure and control over spending patterns and encourages mindfulness in fiscal matters while aligning expenditures with long-term financial goals. By implementing traditional budgeting techniques into one’s money management strategy, individuals gain valuable insights into their own financial behavior, which can lead to improved financial stability and a greater sense of control over their monetary affairs.

The Process of Traditional Budgeting

Traditional budgeting involves a systematic approach to managing personal finances. The process typically includes several steps that allow individuals to track their income, expenses, and savings goals. Understanding the process of traditional budgeting is crucial in order to grasp its advantages and disadvantages fully.

The first step in the process is gathering all financial information. This includes collecting details about income sources such as salaries, bonuses, or any other regular earnings.

Additionally, individuals need to gather information on expenses, which can include fixed costs like rent or mortgage payments, utilities, and insurance premiums, as well as variable expenses like groceries, entertainment, and transportation costs. By thoroughly examining these financial aspects and compiling them into a comprehensive overview of one’s financial situation, individuals can gain a clear understanding of their current standing.

Next comes the establishment of specific financial goals. Traditional budgeting emphasizes setting realistic objectives that align with one’s short-term and long-term aspirations.

These goals could range from saving for retirement or a down payment on a house to paying off debts or funding an emergency fund. By defining these objectives clearly and prioritizing them according to their importance, individuals can allocate appropriate funds toward each goal within their overall budget framework.

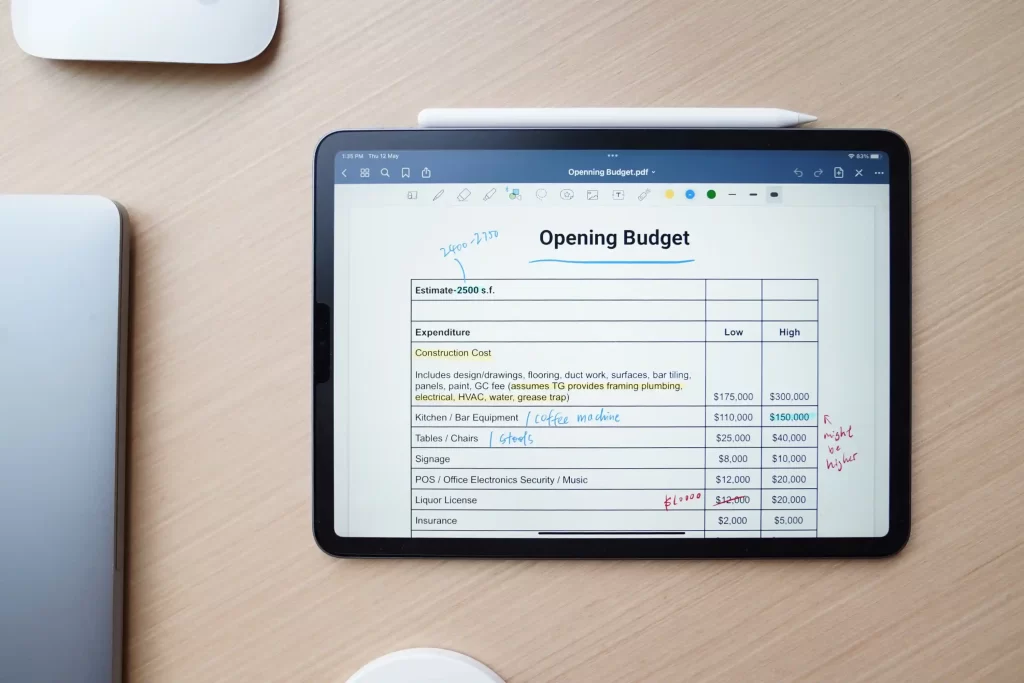

Once the goals are established, it is time to create a detailed budget plan that reflects one’s income and expenses accurately. This involves categorizing expenditures into different groups, such as housing costs (rent/mortgage), utilities (electricity/gas/water), transportation (car payment/fuel/insurance), groceries/dining out, entertainment/leisure activities, debt payments (credit cards/loans), savings/investments (retirement/emergency funds), etc. Careful consideration should be given to ensure all essential costs are covered while leaving room for discretionary spending.

After developing the initial budget plan based on income and expenditure categories, it is important to regularly track actual expenses against planned ones throughout the month or designated time period. This helps identify any discrepancies between the planned and actual spending, allowing individuals to make necessary adjustments and ensure they stay within their budgetary limits.

Regular tracking also promotes awareness of spending patterns and supports informed decision-making regarding financial priorities. The process of traditional budgeting entails gathering comprehensive financial information, establishing clear financial goals, creating a detailed budget plan that allocates income to various expense categories, and regularly tracking expenses against the plan.

By diligently following this process, individuals can gain better control over their finances and work towards achieving their financial objectives. However, in order to fully assess its advantages and disadvantages, it is important to examine each step in detail and consider its suitability for different personal circumstances.

Advantages of Traditional Budgeting

1. Increased Awareness and Control: One of the primary advantages of traditional budgeting is that it enhances your financial awareness and provides you with a sense of control over your personal finances.

By creating a detailed budget, you gain a clear understanding of your income, expenses, and savings goals. This heightened awareness allows you to identify areas where you may be overspending or neglecting important financial obligations.

Armed with this knowledge, you can make informed decisions about how to allocate your resources effectively. Additionally, traditional budgeting enables you to exercise greater control over your spending habits.

By setting specific limits for different categories, such as groceries, entertainment, or utilities, you become more conscious of where your money is going. A clear budget acts as a guide to help prioritize your spending and avoid impulsive purchases that may derail your financial goals.

2. Financial Goal Setting: Traditional budgeting serves as an effective tool for setting and achieving financial goals. When creating a budget, it allows individuals to establish short-term objectives like saving for a vacation or paying off credit card debt while also enabling the formulation of long-term goals such as buying a house or planning for retirement.

By breaking down these goals into manageable chunks within the budget framework, individuals can track their progress over time and adjust their spending accordingly. This methodical approach fosters discipline and motivation in working towards those objectives.

Furthermore, traditional budgeting facilitates the identification of potential cost-cutting opportunities that align with one’s financial aspirations. For instance, when tracking expenses closely through the budgeting process, individuals may pinpoint unnecessary subscription services or excessive dining out expenses that could be reduced to accelerate savings towards their long-term targets.

Traditional budgeting offers advantages, including increased awareness and control over finances as well as effective goal-setting mechanisms. Through meticulous planning and monitoring of expenditure patterns using this methodology, individuals can pave the way toward better financial stability and achieve desired milestones in their personal finance journey.

Disadvantages of Traditional Budgeting

1. Rigidity and Lack of Flexibility: One of the main drawbacks of traditional budgeting is its inherent inflexibility.

Traditional budgets typically allocate fixed amounts of money to different expense categories, which can restrict one’s ability to adapt to changing circumstances or unforeseen expenses. For instance, if an individual encounters a sudden medical emergency or unexpected home repair, they may find themselves constrained by the limitations set within their budget.

This lack of flexibility can lead to stress and frustration, as it hampers the ability to effectively address urgent financial needs without jeopardizing other areas of the budget. Furthermore, traditional budgets often require strict adherence to predefined spending limits for each category.

While this approach aims to promote discipline and control over finances, it can also feel constricting and rigid. Individuals may struggle with feelings of deprivation or resentment if they are unable to deviate from their predetermined spending limits, even when necessary or when circumstances allow for it.

This rigidity can undermine motivation and make sticking to the budget a burdensome task rather than an empowering tool for managing personal finances.

2. Time-consuming and Complex: Another downside of traditional budgeting is its time-consuming nature and complexity in implementation. Creating a comprehensive budget involves gathering detailed information about income sources, fixed expenses, variable expenses, savings goals, debt repayments, and more.

It requires careful record-keeping and ongoing monitoring of expenditures against the allocated amounts for each category. Maintaining such meticulous records often demands significant time and effort from individuals already juggling various responsibilities in their daily lives.

As a result, many people find it difficult to sustain their commitment to consistently updating their budgets over time. Moreover, traditional budgets can be complex due to the numerous variables involved in accurately accounting for all income sources and expenses accurately.

This complexity amplifies with life changes such as career transitions or major life events like marriage or starting a family that demands adjustments in financial planning. Managing these changes within the confines of a traditional budget can be overwhelming and may require constant revisions.

Traditional budgeting has several disadvantages that can affect its practicality and effectiveness. The rigidity inherent in traditional budgets, coupled with their time-consuming nature and complexity, can limit adaptability and strain individuals’ ability to effectively manage their personal finances.

Practical Examples of Traditional Budgeting

One practical example of traditional budgeting is the “envelope system.” This method involves using physical envelopes to allocate specific amounts of money for different categories of expenses.

For instance, you may have separate envelopes for groceries, utilities, transportation, and entertainment. At the beginning of each month, you would withdraw cash from your bank account and distribute it into these envelopes according to your budgeted amounts.

This way, you have a visual representation of how much money is allocated for each category and can easily track your spending. When a particular envelope runs out of cash, you know that you’ve reached the limit for that category and need to curtail your spending until the next month.

Another practical example of traditional budgeting is the spreadsheet method. With this approach, individuals use software programs like Microsoft Excel or Google Sheets to create and maintain their budgets.

Spreadsheets offer a high level of flexibility since users can customize them according to their specific needs and preferences. Users typically input their income sources as well as expenses under different categories in separate columns or tabs.

The spreadsheet automatically calculates totals and provides clear visuals through charts or graphs, making it easy to monitor financial progress over time. Both these examples emphasize the importance of planning ahead and being conscious about financial decisions.

They enable individuals to see where their money is going and make adjustments accordingly to ensure they stay within their allocated budgets. However, it’s worth noting that while practical examples like these exist within traditional budgeting methods, they may not suit everyone’s lifestyle or preferences.

Some individuals may find them too restrictive or time-consuming to maintain accurately. It’s crucial for individuals considering traditional budgeting methods to assess their own financial habits, personality traits, and commitment level before selecting a practical approach that aligns with their personal circumstances.

Case Studies on Traditional Budgeting

Case Study 1: Sarah’s Journey to Financial Stability Sarah, a young professional in her late twenties, found herself struggling with her personal finances due to mounting debt and a lack of financial planning.

Determined to turn her situation around, she decided to implement traditional budgeting as a means to gain control over her spending and save for future goals. Sarah began by meticulously tracking her income and expenses using spreadsheets and mobile applications.

She divided her monthly income into specific categories such as housing, transportation, groceries, entertainment, and debt repayment. By closely monitoring her expenses against these categories every month, Sarah was able to identify areas of overspending and make necessary adjustments.

Through traditional budgeting, Sarah successfully reduced unnecessary expenditures by cutting back on dining out and discretionary shopping. She allocated the savings towards paying off high-interest debts more aggressively while still setting aside some funds for emergency savings.

Over time, Sarah’s strict adherence to budgeting allowed her to eliminate debts entirely and build a solid financial cushion.

Case Study 2: John and Lisa’s Family Budget Transformation. John and Lisa were a married couple with two children who were facing financial strain due to their inconsistent spending habits. They realized that without established financial boundaries or goals, their income was disappearing faster than they could keep track of it.

Motivated by their desire for stability and future financial security for their family, John and Lisa turned to traditional budgeting as a solution. With the help of online tools specifically designed for family budgets, they identified the various components that contributed most significantly to their expenses: mortgage payments, utility bills, groceries (including school lunches), transportation costs (both public transport fares as well as car maintenance), insurance premiums (healthcare coverage for the whole family), extracurricular activities for the children (such as sports or music lessons), retirement savings contributions, emergency fund allocations—the list went on.

By listing each category separately and assigning a specific amount to it, John and Lisa were able to gain clarity on where their money was going and make more informed financial decisions. This allowed them to identify areas where cuts could be made without compromising their quality of life.

They discovered that by reducing discretionary spending, switching to more cost-effective insurance plans, and renegotiating some service contracts, they could make significant savings each month while still enjoying the things that mattered most to them as a family. Both Sarah’s and John’s, and Lisa’s experiences demonstrate the power of traditional budgeting when applied with discipline and commitment.

By closely monitoring their income and expenses through detailed categorization, these individuals found the necessary control over their finances to achieve their goals—whether it was paying off debts or securing a stable future for their families. These case studies serve as inspiration for those considering traditional budgeting as an effective tool for personal finance management.

Who Should Use Traditional Budgeting?

Traditional budgeting can be a powerful tool for managing personal finances, but it may not be suitable for everyone. Understanding who can benefit the most from traditional budgeting is crucial in determining whether this method aligns with an individual’s financial goals and personality. While there is no one-size-fits-all answer, certain characteristics, and circumstances may indicate that traditional budgeting is the right approach.

Firstly, individuals who are new to personal finance or have little experience in managing their money can greatly benefit from traditional budgeting. It provides a structured framework that helps establish financial discipline and develop healthy spending habits.

By creating detailed categories and allocating specific amounts to each expense, beginners gain a clear understanding of their income, expenses, and saving potential. This method also allows them to track their progress over time, providing a sense of accomplishment as they successfully adhere to the budget.

Additionally, individuals with irregular or inconsistent incomes can find value in traditional budgeting. Freelancers, entrepreneurs, or those with commission-based jobs often face uncertainty when it comes to cash flow.

In such cases, creating a well-defined budget helps them allocate funds effectively during times of abundance and prepare for leaner periods by building emergency funds or adjusting spending habits accordingly. Traditional budgeting provides stability in an otherwise unpredictable financial landscape and ensures that essential expenses are covered before discretionary spending.

Furthermore, people who thrive on structure and organization tend to excel with traditional budgeting methods. These individuals enjoy having clear guidelines and boundaries within which they can make informed financial decisions.

The process of categorizing expenses, setting limits for each category based on available resources, and tracking progress resonates with their need for orderliness. They find comfort in knowing where their money is going at all times and appreciate the sense of control that traditional budgeting offers.

While traditional budgeting may not suit everyone’s needs or preferences for managing personal finances effectively, it does hold significant benefits for certain individuals. Beginners seeking financial discipline and those with irregular incomes may find value in this method.

Similarly, individuals who thrive on structure and organization can harness the power of traditional budgeting to achieve their financial goals. Understanding one’s financial circumstances, goals, and personal attributes is essential in determining whether traditional budgeting is the right approach for managing personal finances successfully.

Alternatives to Traditional Budgeting

The 50/30/20 Rule:

One alternative to traditional budgeting is the popular 50/30/20 rule, which offers a simplified approach to managing personal finances. This rule suggests allocating 50% of your income towards needs, 30% towards wants, and the remaining 20% towards savings or debt repayment.

By following this guideline, individuals gain flexibility and freedom in their spending while still maintaining some level of structure. This approach allows for more intuitive decision-making when it comes to managing expenses and ensures that essential needs are met without feeling overly restricted.

The advantage of the 50/30/20 rule lies in its simplicity and ease of implementation. It eliminates the need for detailed tracking of every expense and provides clear guidelines on how income should be allocated.

Moreover, this approach promotes a healthy balance between fulfilling immediate desires (wants) and securing one’s financial future (savings). By focusing on percentages rather than specific dollar amounts, individuals can adapt this method to their changing circumstances as their income fluctuates over time.

Zero-Based Budgeting:

Another alternative worth considering is zero-based budgeting (ZBB), a method that involves allocating every dollar earned towards a specific purpose at the beginning of each month or pay period.

Unlike traditional budgeting, ZBB requires individuals to assign a purpose for each dollar they receive – whether it be for necessities, savings, debt payment, or discretionary spending – with no money left unaccounted for. The key advantage of ZBB is its meticulous attention to detail and comprehensive planning.

It encourages individuals to scrutinize their expenses thoroughly while ensuring that every dollar has a designated role within their financial plan. ZBB also helps in identifying unnecessary or frivolous spending habits by forcing individuals to justify each expenditure explicitly.

However, one drawback of zero-based budgeting is its time-consuming nature and potential complexity in tracking every transaction rigorously. It demands a significant level of dedication and discipline to adhere to this method consistently.

Moreover, ZBB may not be suitable for those who prefer a more flexible approach to managing their finances, as it can sometimes feel overly restrictive. Alternatives like the 50/30/20 rule and zero-based budgeting offer individuals different approaches to managing their personal finances beyond traditional budgeting methods.

Each alternative has its advantages and disadvantages, and the choice ultimately depends on an individual’s financial goals, preferences, and level of commitment. By exploring these alternatives, individuals can find a method that aligns with their unique circumstances and helps them achieve financial stability while maintaining a sense of control over their money.

Conclusion: Is Traditional Budgeting Right for You?

The decision to adopt traditional budgeting as a personal finance tool ultimately depends on individual circumstances and preferences.

While traditional budgeting has its advantages, such as providing a structured framework for managing expenses and promoting financial discipline, it also comes with certain limitations that may not suit everyone’s needs. For those who thrive on structure and crave a clear roadmap for their financial journey, traditional budgeting can be an excellent choice.

It helps individuals gain control over their spending habits, ensuring that they live within their means and prioritize saving for future goals. By setting specific spending limits and tracking expenses meticulously, traditional budgeting allows individuals to make informed decisions about where their money goes, empowering them to align their financial choices with their long-term aspirations.

However, it is important to acknowledge that traditional budgeting may not work for everyone. Some individuals may find the process too restrictive or tedious, leading to frustration or abandonment of the budget altogether.

Additionally, life circumstances can change rapidly, making it challenging to adhere strictly to predetermined spending categories. In such cases, alternative approaches like dynamic budgeting or goal-based planning might be more suitable.

Ultimately, the key is finding a personal finance strategy that aligns with your unique temperament and financial goals while allowing flexibility for unexpected events or opportunities. Whether you choose traditional budgeting or explore other methods, remember that achieving financial success is not solely dependent on the tools you use but rather on how effectively you implement them in your daily life.

By staying mindful of your financial priorities and making conscious choices aligned with your values, you can create a path toward lasting financial security and peace of mind. In closing this article on traditional budgeting for personal finance, let us embrace an optimistic perspective: by gaining control over our finances through whichever method suits us best – whether it be traditional budgeting or an alternative approach – we are taking valuable steps towards building a better future.

Discover the secrets to breaking free from the mundane world of traditional budgeting! Unravel the mysteries of what is a zero-based budget, and unlock the path to financial freedom. Then, journey deeper into the realm of goal-based budgets to unearth the true power of aligning your aspirations with your finances. Get ready to embark on a thrilling adventure toward a brighter financial future! Click here to read more about what is a zero-based budget and here to learn about goal-based budgeting.

It looks cool.